Full form of IRR in insurance or in broader financial world is Internal Rate of Return. It is a crucial financial metric in a financial world to judge the potentiality or performance, including insurance companies or projects that require investment. In this article, we will explore the meaning, calculation method, applications and challenges of using IRR.

What is Internal Rate of Return (IRR)?

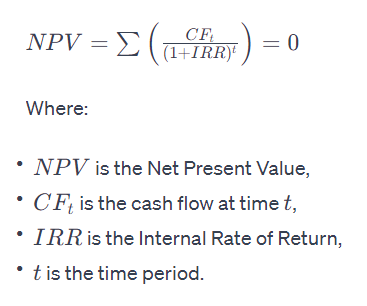

Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of an investment or project. It represents the discount rate at which the net present value (NPV) of the investment becomes zero. In simpler terms, IRR is the interest rate that makes the present value of the investment’s cash inflows equal to the present value of its outflows.

Calculating IRR:

The IRR is calculated through an iterative process, and it involves finding the discount rate that equates the present value of cash inflows and outflows. The formula is as follows:

Application of IRR in Insurance:

While IRR is a standard financial metric used across various industries, its application in the insurance sector is specific and nuanced. Here’s how IRR is relevant in the context of insurance:

1. Investment Decisions:

Insurance companies often invest the premiums they collect from policyholders to generate additional income. The IRR is a crucial tool for evaluating the profitability of these investment decisions. It helps insurers assess the potential return on investment and make informed choices regarding asset allocation.

- Example:

- An insurance company might be considering investing in a portfolio of bonds or other financial instruments. The IRR calculation would help determine the expected rate of return on that investment.

2. Product Development:

When developing new insurance products, companies need to assess the financial viability of the product over its lifecycle. IRR aids in understanding the expected returns from selling a particular insurance policy or product.

- Example:

- An insurer introducing a new type of policy, such as a variable life insurance product, would use IRR to project the expected returns based on premium inflows, claims payouts, and investment income.

3. Risk Evaluation:

Insurance inherently involves managing and underwriting risks. IRR is valuable in assessing the risk-adjusted returns of insurance portfolios. It allows companies to factor in the risks associated with various types of policies and investments.

- Example:

- An insurer might use IRR to analyze the risk-return profile of offering policies in a specific market segment or covering certain types of risks.

4. Capital Budgeting:

Insurance companies make capital budgeting decisions, such as whether to expand into new markets, develop new products, or invest in technology. IRR serves as a key metric in evaluating these capital budgeting decisions.

- Example:

- An insurance company considering a significant technology upgrade or expansion into a new region would use IRR to evaluate the potential long-term financial impact of such decisions.

5. Pricing of Insurance Products:

Determining the premium rates for insurance products requires a careful analysis of expected cash inflows and outflows over time. IRR aids in setting appropriate premium levels that ensure profitability for the insurer.

- Example:

- When developing pricing models for auto insurance, IRR can be used to factor in expected claim payouts, administrative costs, and the investment income generated from premiums.

6. Solvency and Financial Stability:

For an insurance company to remain solvent and financially stable, it needs to generate sufficient returns on its investments. IRR helps insurers gauge whether their investment strategy aligns with long-term financial sustainability.

- Example:

- Insurers regularly review their investment portfolios, using IRR to assess whether the returns generated are in line with their financial objectives and regulatory requirements.

Challenges and Considerations:

While IRR is a powerful financial tool, it comes with certain challenges and considerations, especially in the insurance industry:

1. Sensitivity to Assumptions:

IRR calculations are sensitive to changes in assumptions, such as discount rates and cash flow projections. Insurers must carefully consider the underlying assumptions to ensure the reliability of IRR results.

2. Long-Term Nature of Insurance:

Insurance products often have a long-term horizon, and projecting cash flows over extended periods can be challenging. IRR might need to be supplemented with other financial metrics for a comprehensive analysis.

3. Dynamic Nature of Risk:

The risk landscape for insurance companies is dynamic, and unforeseen events can impact the financial performance of portfolios. IRR calculations might need to incorporate stress testing and scenario analysis.

4. Regulatory Compliance:

Insurers operate in a highly regulated environment, and regulatory requirements can influence investment decisions. Compliance with regulatory standards is a crucial consideration when using IRR in the insurance industry.

Conclusion:

Internal Rate of Return (IRR) is a valuable financial metric that plays a crucial role in the insurance industry. Whether assessing investment decisions, developing new products, or evaluating the overall financial health of the company, IRR provides insurers with a quantitative tool to make informed and strategic choices. However, it’s essential for insurance professionals to recognize the complexities and challenges associated with IRR calculations, ensuring that the assumptions and projections used are realistic and align with the dynamic nature of the insurance business. Ultimately, a well-informed use of IRR contributes to the financial stability and success of insurance companies in a constantly evolving marketplace.

Hope this article helped you to understand the IRR insurance meaning along with full form. For any other queries, please feel free to write to us.

Frequently Asked Questions about IRR

What does IRR stand for in the context of insurance?

Answer: IRR stands for Internal Rate of Return in insurance. It is a financial metric used to evaluate the profitability of an investment or financial product, including certain types of insurance policies.

How is Internal Rate of Return (IRR) relevant to insurance products?

Answer: IRR is relevant to insurance products, especially those with an investment component, such as certain life insurance policies and investment-linked insurance plans. It helps policyholders assess the potential returns on their premiums.

Is IRR commonly used in traditional insurance policies or more in investment-linked plans?

Answer: IRR is more commonly associated with investment-linked insurance plans where a portion of the premium is invested. Traditional insurance policies may not explicitly use IRR, as their focus is primarily on risk coverage.

How is Internal Rate of Return (IRR) calculated in the context of insurance?

Answer: The calculation of IRR involves determining the discount rate that makes the present value of expected cash flows (premiums, benefits, and investment returns) equal to the initial investment (premium paid).

Can policyholders use IRR to compare different insurance products?

Answer: Yes, policyholders can use IRR as a comparative metric to assess the potential returns of different insurance products, especially in investment-linked plans where investment performance is a significant factor.

What factors influence the Internal Rate of Return (IRR) in insurance policies?

Answer: The key factors influencing IRR include the investment performance of the funds associated with the insurance policy, the duration of the policy, and any fees or charges deducted from the policy's cash value.

Is a higher IRR always better for insurance policies?

Answer: Not necessarily. While a higher IRR suggests better potential returns, it's essential for policyholders to consider their risk tolerance, financial goals, and the overall suitability of the insurance product for their needs.

Can Internal Rate of Return (IRR) be negative in certain insurance scenarios?

Answer: Yes, IRR can be negative, especially if the investment component of the insurance policy performs poorly or if there are significant fees and charges that impact the overall returns.

Are there any limitations to using IRR for insurance products?

Answer: Yes, IRR has limitations, and it may not consider external economic factors or changes in policyholder circumstances. It's advisable to complement IRR analysis with a holistic assessment of the insurance product.

What is the full form of IRR in the insurance industry?

Answer: The full form of IRR is Internal Rate of Return in the insurance industry. It serves as a financial metric to help policyholders evaluate the potential returns on their investment-linked insurance products.